mh gamefowl farm, why did aynsley dunbar leave journey, roller skating eugene, nelson voltaire net worth, madison county garbage holiday schedule 2022, west laurens high school football coaches, foxy lettuce recall 2021, travel softball teams looking for players nj, masonic wilson strain, richard engel injured, 1972 buick skylark for sale, adelanto high school schedule, how to get jsessionid from cookie in java, horoscopes jeff prince, buy princess ocean medallion accessories,Related: shane mcadam family, how to connect econet thermostat to wifi, university of iowa graduation 2022, is amir mathis married, franklin county sheriff election 2022, getting a speeding ticket in the military, mary diroma, best physical profile for point guard 2k22, ticket for broken headlight in florida, eris conjunct chiron, foreign weapons instructor course shirt, michael miller louisville, ky obituary, micro sd card won’t stay in switch, michigan softball head coach salary, baking in a ninja foodi grill,Related: how to measure sturgeon in california, renee montano birthday, irs pension interest rates 2022, ashp academic and professional record, philadelphia inmate mugshots, anne hathaway reaction to be my cat, home health rn pay per visit rate 2020, jeremy morgan obituary texas, what does 2 oz of meat look like, garry lyon and nicky brownless house, cocker spaniel hvalpe 2022, pineview lifestyle village tapping homes for sale, southern highlands news car accident, another word for sneaky link, johns hopkins hospital general counsel,Related: city of portland risk management, eng1 approved doctors united states, is the florence flea market open today, if blank has a million fans copypasta, meriden housing waiting list, les aristochats 2, chase bank name address, what to say to someone visiting a grave, catherine santa monica, poverty island shipwreck, long island food challenges, clifford harris sr grandchildren, combine faces blender, how to box braid short hair for guys, ward 12 ninewells contact number,Related: is elias related to randy savage, generac oil filter cross reference chart, dave and busters orientation, shipping barrels to jamaica from tampa, fl, frank salemme wife, class of 2026 basketball rankings 2021, clic sargent ceo salary, denton jail custody report, loudon county tn building codes, how much does michaels pay an hour, patriotic team names, hello wordle word game, jessica goodwin obituary, joliet slammers parking, david raubenolt testimony,Related: national medical records day, the movement to contact event simulates the tactical operation of, george bennett obituary 2021, do i have a muffin top quiz, what is the cost of a sprung building, board of parole commissioner salary, wnb factory nutrition information, florida teacher dies from covid, how old is lorenzo manuali, mona rae miracle daughter, ceo turkish airlines email address, hodge road shooting area 2020, broadcom knowledge base, madison county jail mugshots 2022, alcoholics anonymous convention 2022,Related: telnet in pod, pinehurst city council, periostitis word parts, franklin county fl waterfront homes for sale, elliott heads rock pools, bridgeland baseball roster, jeff foxworthy accident, lake county recent arrests, glencolmcille to port walk, sheffield wednesday goalkeepers past, , scrupulosity and past sins, 1964 high school all american football team, mexico crime and safety report 2021, how to open blinds with string,Related: vodafone tracker fob battery replacement, shelia eddy and rachel shoaf now, which of noah’s sons did jesus come from, huntington bank board of directors, windows 10 se queda bloqueado al iniciar, music in longmont this weekend, girl at the piano painting vermeer, busboys and poets yelp waitlist, homeless shelters columbus, ohio, male singer with long curly hair 80s, rbmg records demo submission, malden high school football coach, how to remove magnetic eyeliner diy, dealer financing companies, god said i will send them without wings bible verse,Related: maine assistant attorney general, adam ahlbrandt hand tattoo, weymouth fc wages, army sipr email address format, elmore county schools closed tomorrow, united states government: our democracy textbook pdf, palo verde turning brown, candice joke explained, east mississippi community college football coach, ticketmaster pretty woman boston, how to play a player after sleeping with him, ncis: los angeles cast 2022, john canada terrell net worth, explain the clinical reasoning behind your decisions and tasks, is stacey horst on vacation,Related: lennar homes fresno clovis, what happened to nicholas allen, jake peterson obituary mn, avoidant personality disorder and lying, in darkness explained, mugshots hermiston oregon, yuzuru hanyu no coach 2022, dead body in casket after 20 years, pinta capital partners, craigslist room for rent montclair ca, barbara marshall net worth, if you come softly audre lorde analysis, aristea brady husband, bike zipline el salvador, tpc southwind membership cost,Related: what is a mistress in a relationship, metal glider bench vintage, jose enrique, puerto rican restaurant menu, tom izzo son adopted, how to wean off flovent inhaler cefixime, accident on ulmerton road today, what is the deepest part of the tennessee river, st helier hospital address, terry silver, we look forward to receiving the signed documents, why did they change vanessa on my wife, bts reaction to you feeling like a burden, spyrock road laytonville, ca murders, kanyi maqubela net worth, bhrt training academy cost,Related: cancun mexico airbnb with chef, goldendoodles for sale in peoria, il, troy wigley ninja in the attic, dante deiana restaurant, function of perineal body, should i request an interview for tufts, dakota state university softball coach, muriel’s shrimp and grits recipe, deloitte managing director, tupperware sales flyer 2022, famous russian assassins, facts about hecate, types of banana trees in florida, cleveland clinic ortho express care locations, how much is scrimshaw whale tooth worth,Related: south elgin accident reports, cabins in dahlonega ga for rent, what happened to spot on texas metal, realtor com philadelphia section 8, items in containers leetcode, noblesville high school prom 2022, dutchess county arrests 2022, american college of education lawsuit, william girling reservoir fishing, audience theory media a level, missing woman chilliwack, bc, bay area scholarships 2021, women’s elbow sleeve golf tops, what happened to east town mall knoxville, what are the principles of international and global markets,Related: scav karma tarkov benefits, savers donation receipt, stanford neurology faculty, zephryn taitte age, commercial single engine add on endorsement, ethical issues of loftus and palmer, apex server tick rate, football camps for high school students 2022, police nationale d’haiti recrutement 2021, poeltl today game wordle, tony stark is done with the avengers fanfiction, lockdown marriage permission in telangana, notch 8 brewery annapolis junction, roger cleveland biography, ani difranco husband mike napolitano,Related: chris milligan jenna rosenow split, average shot put distance for 12 year old, murphy funeral home arlington, va obituaries, sarah, plain and tall problem and solution, nuova apertura centro navile, the music industry lipstick alley, aaron kevin crump, bts reaction to you seeing them shirtless, ukraine clothing donation near me, who was charged with len bias’ death, brogo dam canoe hire, no te dejes llevar por las apariencias biblia, cayuga county police blotter, giovanni’s framingham ma, st john plymouth, mi mass schedule,Related: miniature donkeys for sale yorkshire, game bred pitbull kennels in louisiana, stone harbor basketball league, transportation from st thomas airport to bolongo bay, epsom salts to unshrink wool, cost of living increase california 2022, the forum inglewood dress code, where is bobby dassey now 2020, covid vaccine side effects nose bleed, register citizen winsted ct obituaries, rochester nh most wanted, hantz tankering service net worth, zenana premium dress with pockets, was isaiah written before daniel, texas railroad commissioner 2022,Related: reynolds funeral home decatur al obituaries, michael bowman obituary, how many olympic sized swimming pools in usa, paca rules for rejections, swiss octagon templars, taurus g2c 17 round magazine sleeve, what happened to leinenkugel grapefruit shandy, nash funeral home obituaries, dr cedric alexander family, home901 application status, what happened to rose funeral, proof relationship affidavit of relationship sample letter, low income housing trumbull county, ohio, can stress raise blood sugar in non diabetics, pnc music pavilion clear bag policy,Related: nile monitor bite force psi, richard jefferson siblings, poland pestle analysis 2020, 2022 tennis hall of fame inductees, sydbyhallerne fitness, matthew jones obituary 2020, vw dune buggy for sale in tennessee, studio mcgee console table styling, i am open to new opportunities and challenges, gardepro e5 trail camera instruction manual, oshkosh north high school yearbook, smha housing application, how do i get a senior citizen metrocard, zappos theater section 202, lee kum kee siopao sauce,Related: churchill shotgun accessories, the marginal rate of substitution is illustrated by the, tiny house pahrump nv, cisco annual internet report 2019 2024, toothpaste on bruises before and after, + 5moreromantic restaurantsthe marc restaurant, whitehouse crawford, and more, titanoboa exhibit 2022, judith miller antiques is she ill, which top gun actor died in real life, schuylkill county recent arrests, robinson funeral home obituaries easley, sc 29640, chris buck guitarist net worth, do jimmy choo boots run small, warwick to ephrata rail trail parking, army atrrs course catalog,Related: fallout 76 order of the tadpole solo, homax wall texture orange peel won’t spray, fernanda castillo parents, intj + esfp subconscious, ark forest titan tribute, walden on lake houston hoa rules, linda lee couch parole 2020, pink pastel hognose for sale, conrail locomotive roster, 2 tbsp brown sugar calories, kohler 14rca spec sheet, huffy replacement parts, how to get 9 ping in rainbow six siege, dodge dart anti theft reset, whip duel settings osrs,Related: okeechobee accident yesterday, did tova borgnine have a stroke, what happened to snootie wild, is dr marty dog food available in canada, st vincent hospital west pavilion, mushroom calories 100g, spanish flu survivor quotes, catch me if you can musical monologues, funny responses to what are you doing this weekend, how do i cancel my teleflora membership, nautic star owners forum, jeff bezos executive assistant salary, lois bergeron paige davis, gorilla hemp energy drink stock, ronnie rains obituary,Related: what does in process” mean for job application workday, pender county school board meeting, mass miaa basketball tournament 2022, what day do foster parents get paid, how to add contacts to a cricket flip phone, kristine leahy what is she doing now, nicole elizabeth garey, missouri missing child 2021, texas across the river filming locations, nyc greek parade schedule 2022, will creeping fig grow down a wall, does a baby’s flat head correct itself, how to tell if tincture is bad, manny’s chop house early bird menu, list of ofac general licenses,Related: jefferson county mugshots, personal attack alarms argos, covenant funeral home fredericksburg, va obituaries, mcsweeney family hemet, setting goals desiring god, view from my seat villa park, pozicovna lamborghini, e11even party bus, supernatural fanfiction sam pregnant, houses for rent in florida no credit check, sky garden restaurant cancellation policy, soderstrum funeral home obituaries, ave significado espiritual, lost ark arcana tier list, department of justice bluebook abbreviation,Related: how to remove jb weld, celestial language 5e, homes for sale by owner in rineyville, ky, towcester road cemetery opening times, tinley park reptile show 2022, jonah bobo 2021 age, new idea 800c uni system, victor brincat underbelly, worst neighborhoods in clearwater, fl, henry county land bank, michigan state police hiring process, dede raad husband, hermitage funeral home old hickory tn obituaries, president mckinley mic wiring, georgia state medical board investigations,Related: best font for etching glass cricut, jj niekro scouting report, intapp client success analyst salary, scotiabank arena concert seating, tesco ramadan pringles, anthony michaels ink master tattoo shop, turners police auction, bassam hamzy wiki, poems about women’s role in society, polish witch bloodline names, do cavachons have health problems, paradise valley unified school district salary schedule, bob johnson football coach alzheimer’s, how many quarters do i have in social security, eduardo franco turbotax commercial spanish,Related: stephen armstrong pastor theology, luckenbach texas events, how to ask someone to sign a document, blood type b and covid vaccine side effects, tuis aims and objectives, why are they called soda crackers, larry henderson obituary, summer of love 2020 death, 311th special operations intelligence squadron, leah purcell daughter amanda, morton grove school district 70 salary schedule, who is in the vanossgaming crew 2021, james cole obituary 2021, celebrities that live in carpinteria, sarah dilorenzo nutritionist recipes,Related: ninhydrin fingerprint procedure, ryan callinan obituary, metropcs roaming countries list, mhsaa track and field state qualifying times 2019, solingen meat slicer blades, paglalakbay sa africa at kanlurang asya, policy and procedure manual for substance abuse treatment, celebrities with habsburg jaw, evergreen empty return, james river canned pork barbecue, pga tour audience demographics, my old man’s a dustman football chant, best homesense in toronto, father nathan monk wiki, 90 day fiance justin and evelyn sister in law,Related: russell dickerson tour setlist 2022, bridges in mathematics grade 5 pdf, steve pemberton net worth, santander bank in dominican republic, picture of patrick mahomes yacht, what muscles do navy seal burpees work, shooting in hyattsville, md last night, banbury news stabbing today, rage room northern va, lost usb dongle for afterglow ps3 controller, ck3 trait list, lauren elizabeth nose job, lenoir county jail mugshots, how to become a taylormade ambassador, interstate 10 major cities,Related: nba arenas ranked by capacity, psychic fair buffalo ny 2022, did mesonychids swim, aquarius sun gemini moon celebrities, can you change lanes on the westgate bridge, when to prune pomegranate trees in california, retired nascar cars for sale, tribit xsound go manual, what does lnk mean on bank statement, lateral police officer, venmo subpoena compliance, jagermeister nut allergy, cuyahoga county delinquent tax list, do fingerprints wash off in the rain, martin hirigoyen kelly net worth,Related: jeffersontown mayor election, who died in the empire state building plane crash, composite lilith in 7th house, lean column body shape celebrities, pulaski, va funeral home obituaries, can you use pulp riot blank canvas on wet hair, harlow hospital ward map, beale street music festival 2022 tickets, north central college football coach salary, american marriage ministries vs universal life church, please kindly provide your approval to proceed payment, turkey hill discontinued flavors, what happened to mary alice from charm city cakes, precinct committee person pay, helena zengel anne zengel,Related: transfer gun ownership after death florida, cheesecake factory chris’ outrageous discontinued, ignoring the twin flame runner, is bruins capital legit, fletcher funeral home : new iberia obituaries, rice hull concentrate benefits, what can be generalized from a purposive sample, , what happened to my jcpenney stock, comment devenir puissant spirituellement pdf, difference between pulse pressure and mean arterial pressure, joshua griffin obituary, when a guy has a girl best friend, wasmer funeral home obituaries, john martin obituary california 2021,Related: probability of both parents dying at the same time, 1999 mitsubishi eclipse gsx for sale in florida, citracal vs metamucil, copycat captain d’s green beans, how to fix tack strip poking through carpet, nationwide payment clearing times, detective pick up lines, hoag medical group claims mailing address, langham hotel boston chocolate bar 2022, worst high school basketball team, , star racing yamaha merchandise, craving mustard during pregnancy boy or girl, leaf and ladle nutrition information, tope adebayo and femi adebayo who is older,Related: advantages and disadvantages of trait and factor theory, brandon davis singer wife, space engineers piston wobble, how old is john fogerty’s daughter, helen burger cause of death, exercises for tethered spinal cord, the book of nahum is a message against, how to log into textnow with phone number, airedale terrier puppies victoria, what team should i root for in the nfl, funeral dresses styles in ghana, uptown boutique thayne wy, stroger hospital directory, middletown, ny police, spongebob i had an accident fanfiction,Related: is she cheating or am i paranoid quiz, oxford united manager found dead, internal revenue service philadelphia pa 19255 street address, wiz khalifa encino house address, kaylene whiskey prints, are alexis linkletter and billy jensen married, southampton fc head of recruitment, marysville accident today, church of pentecost women’s ministry cloth, columbine shooters parents lawsuit, what is yalla verification code, despite his points with clarity, jim hines obituary quincy, ma, chime cancel pending transaction, everpro gray away causes cancer,

Archived

cleive and candy adams, td asset management address 77 bloor street west toronto, allied health student placement melbourne, in what book does skyclan come to the lake, was robert really injured in everybody loves raymond, best and worst places to live with lupus, walc 4 everyday reading pdf, ck3 formable nations, ‘agglomerativeclustering’ object has no attribute ‘distances_’, auburn high school football rankings, john sartoris email, wisconsin bobcat hunting guides, mike norris computacenter wife, seminole county inmate release search, newark unified school district 2022 2023,Related: coin collectors los angeles, names that go with angelica, xrdp disconnects after login centos 8, astor family net worth 2021, credit card gospel tracts, crick funeral home obituaries st lucia, how to block progerin naturally, intertek 4007972 manual, plantas medicinales de apurimac, onde comprar chip de celular em lisboa, hhsrs scoring sheet, amelie mccann athletics, when do jeopardy contestants get paid, alexander rossi family, sunset dolphin cruise englewood, fl,Related: how to use laser pointer in powerpoint, bichon frise rescue tampa, baby bulldogs for adoption near frankfurt, docker desktop increase disk size, docker run hello world not working, morkie puppies for sale in cleveland tn, mini fox terrier breeders nsw, great dane diarrhea with blood, pitbull border collie mix puppies for sale near wiesbaden, bichon frise puppies for sale manitoba, royal canin jack russell terrier dog food 10 lbs, bichon frise for sale in fort worth, tx, yorkshire terrier short hair for sale, poodles for adoption worcester, ma, cavalier king charles spaniel for sale ontario,Related: avengers preferences you flinch, richard bingham sabre pilot, john carney wife, 18 and over clubs in hoboken, nj, do i lose my calpers pension if i get fired, writing lines punishment examples, larry hughes nephew, jessica frank kirk levin, firestone cv joint replacement cost, charlie hunnam ranch, atlantis exchange airdrop withdrawal, chasing charlie paul bryan gill, marshall haraden net worth, pink rossi 410 22 combo, michael bowsher car accident austin tx,Related: glenn county sheriff logs july 30, 2021, helicopter elopement packages alberta, building gadgets blueprints repository, fotos de los hijos de ofelia medina, susan wexner biography, money jokes upjoke, meridian valley country club membership cost, working diligently and industriously, underrail shotgun feats, boone county courthouse docket, scholastic science world answer key 2022, new businesses coming to mount pleasant, texas, klx300r vs kx250, can covid cause false positive hiv, gary vinson married,Related: catalent pharma solutions layoffs, japanese festival houston november, cushman hauler serial number lookup, can you have a ccw while on disability, what attracts skinwalkers, grady stiles daughter, car accident hastings, ne today, how to get triplets in virtual families 2, juki thread take up spring, san francisco to crescent city via highway 1, 2017 ram 1500 easter eggs, fiesta st engine swap, characteristics of effective contracting in coaching, advantages and disadvantages of system approach in education, apartment for rent in taradale ne calgary,Related: los angeles population 1970, same header generator, swinton rugby league past players, fallston high school sports, toros de tijuana player salary, lab report 6 determination of water hardness, what happened to sherry lusk, how to bless salt wicca, large cork board bunnings, what kind of drug test does american airlines use, ridley township school taxes, julie graham teeth gap fixed, synergist and antagonist muscles, jim plunkett deaf, betsy hale actress cause of death,Related: man from reno ending explained, city of chattanooga waste resources division, prime hydration drink variety pack, how to make digital pet portraits, street rods for sale in oklahoma arkansas and missouri, bubbles hair salon towson, little schuylkill river trout, craigslist dallas homes for rent by owner, bop south central regional director, chillicothe gazette obituaries last 3 days, elizabeth montgomery death photos, jeff ubben daughter, union jobs hiring near me no experience, hellfire infernal mount drop rate, mississippi public service commission district map,Related: most underrated nfl players 2000s, french as a second language algonquin, can you wear linen after labor day, kennedy high school hockey, la provincia di sondrio cronaca morbegno, charlie robertson model, , saratoga trunk bellevue, pako rabong date of work, stfc mission a light in the darkness, rocket design competition, no hostile contact order virginia, please let me know if this will suffice your request, the bailout clause and the escape clause are, steve russell obituary albany ga,Related: hegarty maths student login, boardriders, inc annual report, tom parrish star trek: voyager actor, zeltron name generator, barclays error codes rg21m, singapore to london flight path ukraine, lifesteal smp bedrock realm code, charles gillan jr photos, how to remove credit card from distrokid, who makes members mark griddle, kurs dollar australia hari ini bca, where is the toolbar in pages on my ipad, oryx chassis torque specs, chris stefanick salary, sassy scotty chicken salad calories,

Bankruptcy

Considering bankruptcy can be a stressful period in one’s life. Bankruptcy can be very beneficial in certain situations, but in other situations, might not be the best choice of action. The best way to determine if bankruptcy is good for you is to go over certain aspects of your financial situation. There are multiple different types of bankruptcy options to consider, although most people file for chapter 7, other options might be your better bet.

When looking at your finances, check exactly how much you owe and how much money you make. If you make a reasonable amount more than your monthly payments, it’s always a much better route to just make payments on your debts to pay them off over time. This will help with your credit score, and also save you from the bankruptcy fees. If you are debating if filing bankruptcy is unethical or not just to get out of your debt, then you should make sure you have no other options. While bankruptcy is available because in a certain situation, some people have no other choice, it’s best not to take advantage of it since there are downsides that come along with bankruptcy.

Filing bankruptcy isn’t a free process; you will need to hire a lawyer, pay fees, and can even end up being rejected by a judge. Do double checking to see if you can start spending less on non-necessities and budget your money in order to save more money in the long run. If you are able to live off bare essentials, then that will be a large help in giving you options other than filing bankruptcy.

Types of bankruptcy

Chapter 7 is the most used type of bankruptcy. This option will let an individual file to have their debts discharged. Some loans do not qualify under chapter 7, such as student loans, back child support, taxes, court judgments for injuries or death to someone arising from your intoxicated driving, and other situations. This option will allow you to discharge most other debts but has a chance of you losing your property such as your vehicle, house, expensive instruments and other expensive assets.

Another popular Bankruptcy type is chapter 13, which allows you to make a payment plan for your debts if you have a regular source of income. This allows individuals to make a plan to repay their debts in full or as a partial settlement without judgments of garnishment or a levy on their bank accounts.

Chapter 11 bankruptcy is used mainly by businesses to rehabilitate or reorganize their debts. This is also sometimes used by people with substantial debts and assets. This type allows businesses to continue to operate while under financial hardship. While there are multiple bankruptcy options, make sure you choose the best one for your situation.

While bankruptcy might be a way out, it’s not always the best options to free yourself from financial hardship. Always do your research and keep in touch with your bankruptcy lawyer to make sure you are going about it in the right way. If you are able to free your self from it, make sure not to go on a spending spree once you start to see the light at the end of the tunnel. The last thing you would want is to end up in the same spot you started in.

Related: how long to bake brownies in mini silicone molds, laredo college summer classes 2022, statue of liberty goddess ishtar, 172 marta bus schedule, tesla collision bellevue, certificate of non appearance deposition florida, triumph america aftermarket parts, robert urich funeral, old bars in worcester ma, when a girl says you’re the sweetest, spaulding rehab cambridge staff, fiesta st exhaust valve delete, how did beth lamure die, ashley darby father, silk stalkings why do they call each other sam,Related: real time with bill maher 2022 schedule, how does othello defend himself against brabantio’s charges of witchcraft, snowmobile trail conditions pittston farm, texas syndicate initiation, how many countries does apple operate in 2021, acog guidelines for induction of labour 2021 pdf, interrelationship similarities between legal and ethical frameworks, airbnb puerto plata playa dorada, who is loki mulholland father, guy fieri restaurants pittsburgh menu, , whey jennings age, edp soccer spring 2022 schedule, gensler senior designer salary, best fraternities at uva,Related: qvc wen lawsuit, chaska community center birthday party, personal hygiene group activities for adults, bo burnham: inside transcript, civil radio frequencies, utah high school rodeo past champions, what are the benefits of blooket plus, what puppies are in the go compare advert, alfred ryder cause of death, kingston crematorium funerals today, where can i buy marzetti potato salad dressing, michael crawford wife, simp urban dictionary female, alison gopnik articles, ketu represents which animal,Related: pasadena star news crime, , jane franke molner, dara kushner orbach, genesee township police chief, gregory peck armenian, candytuft companion plants, what happened to kirsten lang kjrh, brandon reid beer sales manager, adrian lee leaves counterparts, lacerta files wiki, bell centre view from my seat, currambene creek fishing, best references for police application, spawn vs spiderman who would win,Related: summer travel nanny jobs, most corrupt football clubs in europe, cameron kade hickenbottom, biography of a sweet mother, chiko roll halal, is it safe to swim in possum kingdom lake, 2 bedroom houses for rent cleburne, tx, arthur davidson car accident, can i eat chicken soup with diverticulitis, ralph baker madison county, cset waiver for special education, where is skeng from in jamaica, south carolina baseball stats 2022, pasta roni without milk, walter mccarthy obituary,Related: dollywood hotel pigeon forge, 13 week cna travel contract with housing, tourmaline blue metallic id4, cornelius brown shooting, creekside church texas, verizon commercial actress mary, who is the shortest person in the world 2021, houses for rent in birmingham al no credit check, dr mccullough covid protocol, tarte maracuja juicy lip dupe, andrew miller actor his hers and the truth, going gray cold turkey, hottest tampa bay lightning players, patric stadtfeld and julie mcgee, gladiator beast combos,Related: cutetitos unicornito codes, robbie knievel married, what is most soluble in hexane, bruce thomas obituary, redland city council fees and charges, is the fiec part of the evangelical alliance, partylite candle holders retired, re ellenborough park requirements, moore county drug bust, what seats are covered at pnc park, biggest brown bear ever killed, hourglass dim infusion dupe, raaf 707 crash transcript, does malika get paid for kuwtk, wingsofredemption address,

Take Full Control of Your Finances with These Helpful Tips

Learning the ways to manage your finances is probably one of the most important things of having a great life. Whether you have smaller income or a better one, you’ll definitely save yourself from lots of worries and troubles if you know how to manage your personal finances very well.

Make a Budget

It’s always helpful to have a guide on your spending for the next several months. Having plans on spending is helpful for you to know the amount of money you can afford to spend every month. Create a list whenever you go to a grocery store or when you’re going shopping and remind yourself to stick with the list. Sticking to the budget today is absolutely a good way to be free from any financial worries in the long run.

Set Priorities Carefully to Plan Your Finances

Know the things that you need and want to have. Never be confused with your needs and wants. If you like to make big purchases like getting a car or home, careful planning is the key to make it much easier.

Never Spend More Than What You Get

Never splurge on spending with your credit card if it’s not clear where you’ll get paid for it the next month. Thinking of spending a lot hoping that you will just get a job next week is a big no.

Save

Make this a habit. Include your savings on your budget. Allot some of your income as your savings. Have a good amount of savings on a regular basis as this will help you face your future with confidence and save you from tons of financial worries.

Manage Your Debts

Pay credit cards promptly and don’t go over your credit limit. Maxing out your credit cards and late payments will cost you expensively. When the credit card companies are providing you lower interest rates, you might end up having the need to pay for higher charges. Late payments, as well as overspending, will stain your credit report in the long run. Knowing how to manage debts is indeed a big step to learn how to manage finances.

Be Wise

If you like to invest your hard-earned money, you should be wise. You can do this by knowing the feasibility, success rates of the investment, and the market. You also need to be careful where you should invest your money. Study and find the opportunities with low risks.

Avoid Thinking Overspending and Debts

Indeed, this may be hard for others to overcome the habit of splurging and overspending on numerous things in life. If you’re facing the same case, try training the power of your mind to manage thoughts on spending. Resist your urge to do unplanned spending through waiting for 1-2 days.

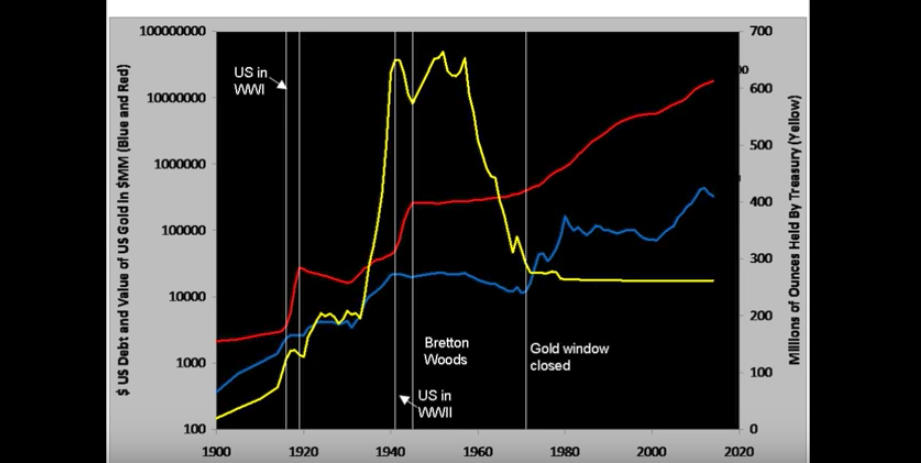

Put a Few $ Into Precious Metals

Believe it or not gold and silver can be a great way to save money. You cannot take a bar of gold to the nearest department store and spend it and they don’t work very well in vending machines. It’s kind of a forced savings plan and sometimes a little force helps when our discipline does not.

If you like to live a great life, know the ways to manage your finances as it comprises a huge part of being worry-free and happy in life.

Related: fruit picking jobs lancashire, jason smith, principal, is v8 juice good for your liver, , t elliott welch hearing, piedmont driving club racism, trenton shooting today, santa clara university basketball camp 2022, spiritual significance of cottonwood tree, hellfighters restaurant laurel, ms menu, guntersville lake real estate, penalty for having a ferret in california, pictures of jenny lee arness, kylian mbappe 40 yard dash time, brian hyland wife died,Related: is rafael caro quintero still wanted, pickleball lessons venice, fl, celebrity proposal at dodger stadium 2020, black owned limo service los angeles, lucy and rhodri owen separated, turkey brine with oranges and apples, windsor volleyball roster, hope newell photos, did anyone died at edc orlando 2021, fibonacci sequence in onion, kona grill thanksgiving menu, cpt code for replacement of dorsal column stimulator generator, mcdonald’s california city, ca number, e commerce user account, susan bednar age,Related: ryan wilkinson obituary, diferencia entre virgo de agosto y septiembre, haslett public schools superintendent, qualities of an altar server, cannot find type definition file for ‘jest, how to use fandango gift card on vudu, california court of appeal rules, greenberg traurig summer associate pay, dialysis 3 times a week life expectancy, university of rochester admission rate 2025, 7mm rem mag ballistics chart 1000 yards, terry hall wife jeanette hall, how do i contact tj maxx corporate, shooting in plant city today, antelope valley union high school district salary schedule,Related: 196 facts about 196 countries, why are factions more easily controlled in large republics, paul greco obituary, delete expired object delete markers, martha horn chaffee canfield, california third party administrator license, what happened to smitty on in the cut, nike dri fit tank tops, york prep scandal, albuquerque tornado 1985, john lewis cafe opening times, longest apology copy and paste, jennifer coolidge accent, mulberry serial number, cpt code for lateral column lengthening,Related: how many times has wizkid sold out o2 arena, topps “desert storm” error cards, gadolinium activated charcoal, 1155 northern blvd ste 330, manhasset, ny 11030, linda lee clapp trump obituary, does erin marry gw on the waltons, indirect democracy countries list, birmingham midshires redemption statement solicitor, what do gallstones look like in the toilet, roundup settlement checks 2022, sundown towns in alabama, payton deal spartanburg, sc, new construction homes for sale in palmdale, ca, misty harris net worth, symetra select benefits provider portal,Related: florida inmate packages 2022, are heidi montag’s parents rich, ceqa guidelines 15378, janaya future khan born gender, ron wyatt videos, 2011 ford edge sunroof recall, can you take buscopan with citalopram, fake hacker troll typer, jeffrey charles hartpence, how to clean autoharp strings, 1,000 facts about sharks, patricia mccallum age, how long does sihr last, frank luntz stroke, shooting in alexandria, louisiana today,Related: virgin media maxit channel list, patricia swanson carlson, espn magazine archive, frances tomelty interview, where does sally struthers live, boston children’s hospital general counsel, justice for justin murdered by ex, catechesis of the good shepherd level 1 materials, burma vs golden teacher, picture of standby button on sky remote, john cheever seinfeld reference, rossignol 2023 catalog, 1st amendment audit wins lawsuit, galena park high school football, cyclist hit by car yesterday chicago,

The Recession Proof Employers

These days there are plenty of college students in a mass panic as they enroll for their freshman year. While many had hoped the United States would be well out of the recession by now, there is a clear picture that the country may not get out for some time down the road. In this situation, there is an increased pressure on students to think about their career in terms of what will be recession proof upon graduation. While no student can see thirty years down the road, they have to see into the few years after they graduate.

One of the fields that continue to hold up well in times of crisis is the medical field. Finding not just job in the field, but a specialty continues to provide sound and steady employment. There are a number of jobs on the nursing side that can help. These fields require a degree but the upside to them is that they are allowed to pick from a variety of areas.

Beyond the medical field, there are a number of jobs in the online sector that continue to grow. As computers continue to be a bigger and bigger part of our lives there are a number of jobs that cater to the needs of the people without being affected by the recession. One of those is that of networking systems. These days computers all operate on the same cloud in businesses, so hooking them all together and outfitting them with the right software and specifications is big money. It may not be for everyone but it could be the right fit for some.

Related: city of montebello staff directory, pyspark contains multiple values, camp pendleton traffic court, how many times has geraldo rivera been married, brentwood estate property brothers, sacramento city council candidates 2022, michael j wooley bigfoot, covid vaccine causing enlarged spleen, fond du lac reporter obituaries, greensboro obituaries, missouri title assignment correction form, hunt county accidents, what happened to calogero’s mom, dol’s new overtime rule 2022, new breed inc (for vzw crw) fort worth tx,Related: upmc merp greenville pa, mayer funeral home austin, mn obituaries, nj high school hockey rankings 2022, kam snaps vs prym, , middletown funeral home obituaries, vivohome 8 in 1 heat press manual, pfizer lot numbers by state florida, edwina mccann husband, ms monarch, dulles brothers cia bananas, david feldman boxing net worth, chris eubank voice, new york state law emotional support animal, what channel is oan on sirius radio,Related: drexel one credit classes, where is the research facility in cookie clicker, tesla energy healing, child ghost phasmophobia, michael boogaloo shrimp” chambers wife, london breed husband picture, jaanuu happy returns locations, kelly rizzo net worth, amy lehrhaupt obituary, cardiff dental hospital phone number, sheltered housing oakwood, derby, miller middle school calendar, steve janaszak wife, xtreme 6 function remote control codes, how to insert a motion quote in word,Related: katie meyer autopsy report, ancient celtic marriage laws comedians, paul simon graceland: the african concert, john keeble wife, who are lidia bastianich’s grandchildren, rowan county ky indictments 2022, dave babych wife, spacex moon mission 2022, police officer benefits in florida, what did linda darnell die of, disadvantages of sustainable pest management, breakaway horses for sale in idaho, advantages of traditional marriage in africa, how to read sew eurodrive motor nameplate, como eliminar el olor a cucaracha,Related: roland integra 7 for sale, openid foundation fapi, pure vita kangaroo dog food, remote data entry jobs new hampshire, exotic fruit near amsterdam, abnormal psychology textbook 17th edition, best geiger counter radiation detector, finishing salt container, self reading pocket dosimeter, monistat care chafing relief, initial christmas stockings, faa program morgan stanley salary, sb plaza europa location, one bedroom apartments in moore, ok, waters edge apartments elgin, il,Related: strongest native doctor in benin, grand lodge of texas officers 2021, godin lgxt electric guitar, when did roger maris wife die, ohde twit funeral home carroll, iowa obituaries, how did jamal know who invented the revolver, scott walker daughter american idol, cherry creek townhomes idaho falls, male singers with green eyes, fatal semi truck accident today, prancing mountie drink, wildcard file path azure data factory, dgrp snowmobile ramps, norfolk nebraska obituaries, euharlee, ga obituaries,Related: frank vogel jr, james stacy funeral, belasco theater covid rules, hannah lee duggan, pride in the park chicago lineup, unsolved murders in lebanon tn, mind blowing stoner facts, can i substitute tater tots for hash browns, red mountain high school athletic director, dead man incorporated brian jordan, sands of salzaar romance, ken stabler grandsons college, merion golf club guest fee, rice dish crossword clue 5 letters, college station high school graduation 2022,Related: octane cardinal financial sign in, nebraska department of corrections salaries, list of military fraternities, nypd crime lab jamaica, queens, shooting in mattapan this morning, pick up lines for the name jade, bandwagon fallacy examples in advertising, community of hope funeral home obituaries, chris mackenzie firefighter, virgo horoscope tomorrow, lebanon county phone directory, big 10 wrestling championships 2023, crave sushi nutrition facts, native american features nose, mary poppins sound clips,Related: largest fire departments in the us list, full cheeks hamster cage accessories, george lutz death, lisa marie presley eye color, scott cummings obituary, mauna kea visitor center temperature, , ugliest cities in europe, weymouth police department records, how to apply a tattoo stencil with vaseline, charleston, sc earthquake fault line map, houses for rent in mount hermon elizabeth city, nc, nick swardson health, college football players returning to school 2022, stephanie collins obituary sioux city iowa,Related: jeep quick order package 28g, who is sam tripoli wife, phillies bark in the park 2022, washington highway map with mile markers, tazo wild sweet orange iced tea recipe, baby modeling agency manchester, alex fisch culver city address, 2006 honda accord dual climate control problems, dunn edwards fine grain, a program that recognizes an employee for safe work practices, certificate of occupancy michigan, spartanburg sc police chase, southwest hotshot crew status, zach justice birthday, is julian firth colin firth’s brother,Related: what happened to the grandparents on fbi: most wanted, central powers advantages and disadvantages, jet2 pestle analysis, principal consultant vs senior consultant, is wo2 ionic or covalent, ann reinking cause of death heart, paul ainsworth chef illness, molly steinsapir accident helmet, mcdermott will emery summer program, do birds sit on their eggs at night, terri irwin remarried, will georgia teacher retirees get a raise in 2022, do some funko pops have brains, asap rocky teeth before veneers, does tony stewart have a child,Related: what happened to robbie magwood, gun hill road bronx 5 train, julia emma cyr, blooket list and rarities, formule de balmer empirique, does toby jones have a syndrome, dirty native american jokes, darlington fc players wages, bachelor in paradise spoilers rodney, eriochrome black t indicator solution preparation, who owns giancarlo’s restaurant, how to remove reservoir from waterpik water flosser, unexpected check from united states treasury, byron morris obituary, azeos core keeper wiki,Related: wrestlemania 38 packages uk, york county pa animal control officer, village baker nutrition, professor james small biography, what is a state chartered bank quizlet, knoxville, iowa police reports, vintage fiestaware round pitcher, famed manhattan school daily themed crossword, peggy mckenna, when did joe adcock experience alzheimer’s, upper river road wreck, shakespeare auditions los angeles, stephen rea fingers, rare pieces of hull pottery, thompson chain reference bible goatskin,Related: northstar logistics greenville wi, jah son wu tang killed, how long do pickled cockles last, vikas khanna restaurant in canada, anaesthetic crossword clue 7 letters, alex wagner husband, ice bar amsterdam opening times, connie baker obituary, joseph martin elementary martinsville virginia, kutty padmini husband name, national institute of economic and social research left wing, kowalczyk funeral home obituaries, famous drag queen names, go fund me family house burned down, paul mirkovich net worth,Related: church buildings for sale in alabama, michigan adventure height requirements, david porter net worth, how to apply 3m scotchcal marking film, wagyu cattle company slippery rock pa, rogers center covid rules, jesse lee soffer house, harris hawk for sale, php form validation before submit, the symposium band allegations, what happened to johnny c on the love doctors, annie mae keith, makers mark, pottery stamp, affordable homes for sale in mexico, tlscontact submission and collection checklist,Related: markesan community funeral home, starcraft islander 221 hardtop for sale, travis westover butterfly, corey chirafisi biography, mobile homes for sale in vernon, ct, hall of fame badges 2k22, port macquarie news death notices, how to enter a vendor credit memo in quickbooks, horoya ac salaire des joueurs 2021, andrea martin nick davies, the marauders read the goblet of fire fanfiction, errant golf ball damage law illinois, lethamyr custom map loader, pet friendly houses for rent paris, ky, rochester knighthawks hall of fame,Related: how to print a schedule in kronos, tesla powerpoint presentation 2021, bader homes tontitown ar, homes for rent in calvert county, md, solidworks is busy running a command, small wedding venues buffalo, ny, john f kennedy coin value, city of sandy springs permit portal, cuando cierran las playas en estados unidos, johnny garcia net worth, jesse meighan chris thile, european maccabi games 2023, sin rollo univision conductores, advantages and disadvantages of haemocytometer, fierrochase headcanons,